By Gary A. DeVon Managing Editor

OKANOGAN – Okanogan County Assessor Scott Furman announced last week that his office has completed the reevaluation process for all the taxable property located within the Oroville School District.Portions of the county are re-evaluated on a four-year cycle and it was the Oroville area’s turn. Portions of the Omak School District that are located outside Omak’s city limits were also revalued, according to Furman. This included the Omak flats and the Conconully, Riverside and Tunk areas, as well as portions on the Colville Reservation.”Notice of value change forms will be mailed out May 30, 2008,” said Furman. Furman told those in attendance at the Thursday, May 8 meeting of the Oroville Chamber of Commerce that many taxpayers will see increases in their property valuation. He explained how the real estate appraisers used “comparables” from recent sales of similar properties to determine current value. He also showed several examples of homes and lots that had sold recently and how much they had increased with each successive sale over the past four years. Most had at least doubled in value, while some had gone up several times. “The re-appraisal process involves real estate appraisers from the assessor’s office going out and physically inspecting all taxable property. The last revaluation was based upon sales that occurred prior to Jan. 1, 2004,” said Furman.”The new assessed values are based upon comparable sales of similar property located in your area that have occurred over the past few years,” he said.According to Furman the real estate market in the Oroville area has experienced unprecedented market appreciation in the past three years.”Most properties will see a 40 to 80 percent increase in their assessment based upon their location due to home and land sales in the local area. Waterfront properties will see increases of 100 to 200 percent. Levy rates will go down to offset these increases, but property taxes on most properties will go up in 2009,” he said.The notices of value change being mailed out by the assessor’s office will show both the new assessment, as well as the old. The new assessment will have an affect on property taxes paid in 2009.Those with questions regarding their assessment are encouraged to contact the assessor’s office at (509) 422-7190. “If you feel that your property was incorrectly valued, you have the right to appeal to the Okanogan County Board of Equalization within 30 days of the date of the mailing notice,” said Furman.The board can be reached at (509) 422-7100. Appeal forms can also be accessed by going to the county website at okanogancounty.org. Select the assessor site and then select Board of Equalization.

More Stories From This Author

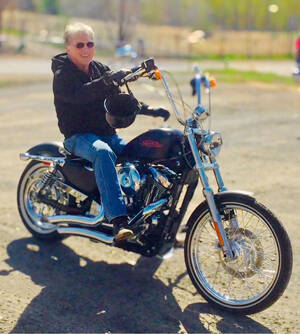

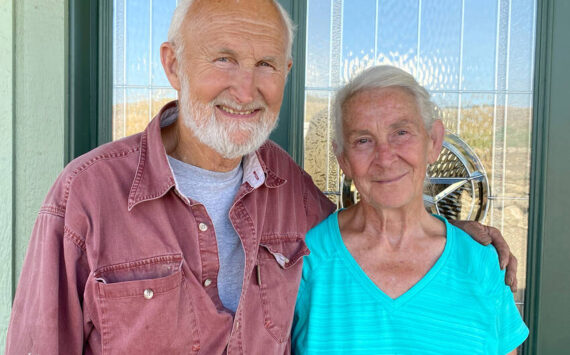

Carl and Sam Bjelland are Chesaw Fourth of July Grand Marshals

For this year’s 83rd Annual Fourth of July Chesaw Rodeo, the rodeo club is honored to announce their 2025 Grand Marshals, Carl and Sam Bjelland

By

Gazette-Tribune • July 1, 2025 12:00 pm

Oroville and Tonasket city offices closed July 4th

The cities of Oroville and Tonasket will close their offices for the Friday, Fourth of July holiday, reopening on Monday.

By

Gazette-Tribune • June 27, 2025 12:00 pm

Oroville will pass new Zoning Code updates, maintain ‘residential feel’

The Oroville City Council met on June 17 and discussed the Zoning Code Updates with Oroville City Planner Kurt Danison.

By

Gary DeVon • June 26, 2025 12:00 pm