When you need fast cash with guaranteed approval, you might want to consider taking out a car title loan. This is a secured loan that allows you to use your car title as collateral.

These loans are usually short-term, high-interest loans that don’t come with too many eligibility conditions. However, if you fail to repay on time, your lender can possess your vehicle.

Here are the top 4 car title loan companies:

- Fast Title Loans – Best Overall for Easy & Fast Title Loans

- US Title Loans – Best for Trusted Title Loans Near You

- WeLoans – Best for Multiple Title Loan Offers to Compare

- CocoLoan – Best for a Large Network of Title Loans Near You

10 Best Title Loans Near Me

Fast Title Loans

Fast Title Loans is the top choice for many borrowers who are looking for an online title loan. Their application process is very simple and they will consider all credit scores, good or bad.

They will also accept most makes and models of vehicles. Their interest rates are very competitive, although the APR with a title loan is usually quite high, and they have a high approval rate, so you can get fast cash at a time when you need it most.

When you submit an application to Fast Title Loans, your loan request is sent to multiple lenders who will quickly respond with loan offers for various loan types including payday loans, personal loans, and installment loans – whatever suits your financial needs.

Pros

- Quick & easy submission process

- Fast approval and funding

- Low eligibility requirements

- All credit scores considered

- Most makes and models accepted

- Friendly & transparent service

Cons

- No mobile app

- Limited availability in some states

Apply for Easy & Fast Title Loans Near You With Fast Title Loans

US Title Loans

US Title Loans makes it easy to find a car title loan company near you. First, get started by submitting all your required information, then you can search for trustworthy title lenders in your state, using the search option on the US Title Loans website.

From this platform, you can choose a lender and check out their services before going ahead. Borrowers with poor credit can also find lenders to provide a solution to their cash needs, and you can keep driving your car while you repay the loan.

US Title Loans is focused on helping you to find the best solution for you and will find the right lender who will accept bad credit. Once you have made your choice, US Title Loans will still be there to assist you, all the way.

Pros

- Easy search option on the website

- No fees for application

- Newbie-friendly interface

- Bank-level confidentiality

- Reliable title loan lenders near you

Cons

- May be restricted in some states

Apply to US Title Loans to Find a Car Title Loan Near You

WeLoans

WeLoans is one of the most well-known and reliable brokers for online loans including car title loans. You can fill out the request form in less than 5 minutes, and WeLoans immediately sends it to lenders for fast approval.

WeLoans has a large panel of car title loan lenders which means you have a wide choice of rates, terms, and conditions. It can link you with car title lenders specializing in loans for bad credit, who may do a soft credit check but will still offer a title loan regardless of your history.

WeLoans can make the search for a car title loan an easy one, and when they put you in touch with a number of lenders you can compare interest rates and terms before making a final decision. It is also important to note that some states restrict the amount that can be borrowed with a car title loan.

The company can also connect you to lenders who will offer various loan types including payday loans and with a car title loan, the maximum amount is up to $5000. There are also lenders in the WeLoans network who offer personal loans up to $35000

Pros

- Extended network of title loans near you

- Wide range of loan types available

- Easy online submission

- All credit types considered

- Higher protection for your information

Cons

- Restricted in some states

View More About Title Loans Near You With WeLoans

CocoLoan

When you submit a request online with CocoLoan for a car title loan, you can get an immediate response from a number of lenders available 24/7. They will assess your car and tell you its current value, and how much you can borrow against it.

CocoLoan can also help if you want to find title loans near you, so you can visit the lender’s office to let them inspect your vehicle in person, which is a quick way to get loan approval. CocoLoan can provide all the local information for title loans near you.

Along with title loans, you can also secure yourself a payday loan, personal loan, or an installment loan from its extensive network of lenders. CocoLoan makes sure that the whole process is quick and easy in 5 minutes or less, and their lenders have an approval rate of around 97%.

Pros

- Large database of title loans near you

- Various repayment options

- High approval rate

- Online service available 24/7

- Bad credit friendly

Cons

- No mobile app

Click Here to Check Out Title Loans Near You With CocoLoan

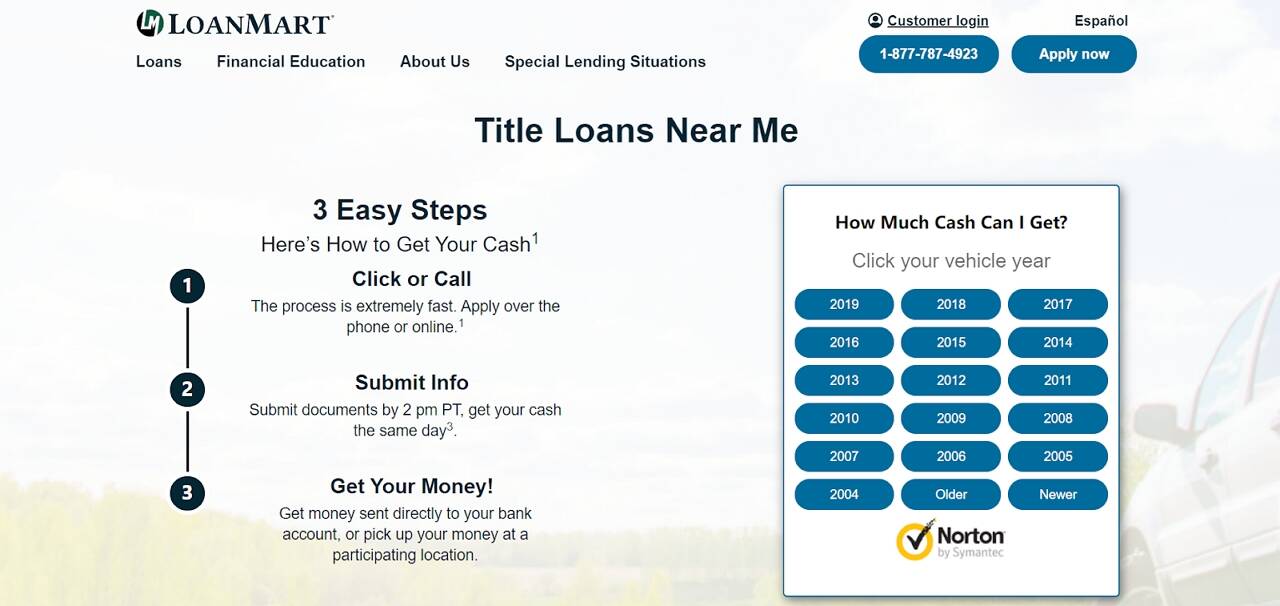

LoanMart

LoanMart provides fast and affordable car title loans to people across the United States, with flexible qualification criteria which helps more people to get the support they need right away. Because they are a direct lender their process is very fast. You can apply online through mobile devices, and if you submit everything by 2 pm you can get the money the same day.

Title loans offered by LoanMart have repayment terms of 36 months and the amount of the loan depends on the value of your car, where you live, and your credit rating. If you have a bad credit history you can still get a title loan from LoanMart but the amount will be smaller.

Pros

- Fast & guaranteed approval

- 3-year repayment terms

- Trusted online title loan lenders

Cons

- Only available in 14 states

- Loan amount related to credit history

Call LoanMart Today to Learn More About Their Title Loans

SuperMoney

SuperMoney’s network of lenders competes for business from clients like you with SuperMoney, so when you fill the form online for a car title loan you will immediately get a number of loan offers. It helps you to sort them out by giving you a list of the lender’s rates, maximum loan amounts, and repayment terms so you can do a fair comparison before deciding on a particular offer.

SuperMoney’s website makes it easy to compare title loans with other loan types and also has information about loans in general. When you submit your details you can get pre-qualified and SuperMoney will let you know the best lenders for your situation, how much you can borrow, and at what interest rate.

Pros

- Supermoney provides a lot of information

- Easy to compare loans

- Prequalification makes the decision process easy

Cons

- The website can seem a bit complicated

Compare Title Loans With Ease With Supermoney Today

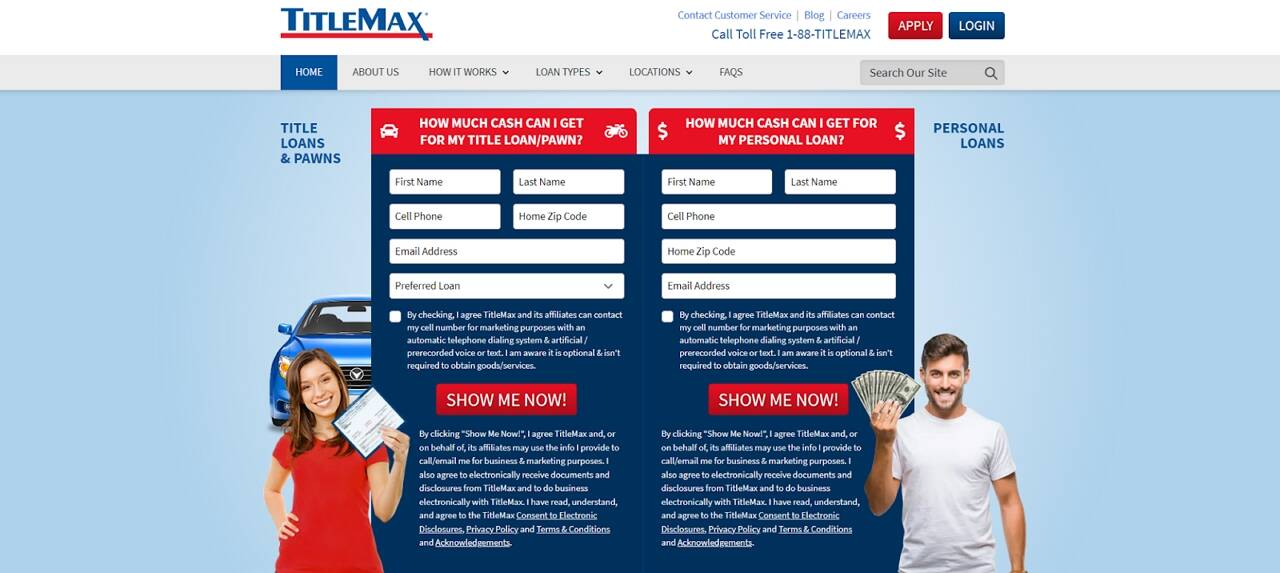

TitleMax

TitleMax is one of the largest and most popular title loan direct lenders in the US. They have over 900 locations in 14 states and have been in business since 1998. TitleMax specializes in car title loans for people who do not qualify for traditional loans due to poor credit or who cannot wait for other lenders to make a decision and provide the money.

TitleMax can approve your car title loan and give you the money within 30 minutes. If you already have a loan that you are struggling to pay off, TitleMax can refinance the loan instantly so you can relax without pressure.

A point to note is that by clicking some links on the TitleMax website you give permission to TitleMax to provide your details to other companies for marketing purposes.

Pros

- Very fast approval and funding

- Poor credit no problem

Cons

- Marketing companies may access your data

- Only available in 14 states

Upstart

You may have purchased your car with a loan at high-interest rates, and now you are struggling with the repayments, so it is time to think about auto-refinancing with Upstart. You can replace your existing loan with a new loan from Upstart at a different interest rate as a car title loan, repaid in monthly installments usually over several years.

Upstart has a sophisticated online platform that looks at 1000 data points to make a decision rather than rely just on credit scores, and it uses artificial intelligence (AI) for predictive modeling to see how the life of the loan will play out. This actually results in more loan approvals because it removes the guesswork from the situation.

Upstart also involves a network of lenders to compare rates and offer the borrower the best options. The interest rates with refinancing may sometimes be higher but the terms are more flexible.

Pros

- Website uses new technology for loan approval

- Flexible terms

- Credit history not required

Cons

- High-interest rates

- Fixed fees for late-payments

Carolina Title Loans

Carolina Title Loans offers easy car title loans to residents of South Carolina, who can qualify for title loans online for up to $15000. Loan applications can be also made in-store; Carolina Title Loans has around 20 handy locations in South Carolina. They work with all types of income whether full employment, part-time or social security, and welcome all levels of credit worthiness. If the title loan is secured against a car, then only the ability to repay matters.

Carolina Title Loans make application and approval quick and easy. After applying online or by phone you will get a call from a representative who will discuss your situation with you. They will check the value of your vehicle and then let you know the amount of loan you qualify for. If you agree to the terms and conditions the loan will be in your hand in-store or sent to your account if online.

Pros

- Fast approval & payment

- All income types considered

- Poor credit no problem

Cons

- Only available to residents of South Carolina

AdvanceAmerica

AdvanceAmerica provides instant cash with car title loans at competitive rates, making it easy for you to get the online title loan you need. They have over 1100 stores so cash is available online or in person. The best way to get a guaranteed title loan is just to bring your car and proof of ownership to an Advance America store that offers Car Title Loans.

A loan specialist will inspect the car in a few minutes and estimate its value. If you agree with that then the loan officer will advise you on the maximum you can borrow against it. If you accept, just sign the loan agreement and the money is yours, it’s a very simple process.

In addition to car title loans, AdvanceAmerica also offers various loan types including payday loans, installment loans, personal loans, and more.

Pros

- Quick and simple process

- Fast cash

- Online or in-store

Cons

- Not available in all states

Title Loan FAQs

What to Consider When Applying for Title Loans Online?

Title loans are usually very simple but there are still a few things you need to check out:

Cost of Loan

The lender has to inform you of all the loan costs before you sign, including interest rate, origination fee, finance fees, and anything else you will be charged – there should be no hidden fees or surprises later.

Penalty Charges

You should know in advance what you will be charged for late payments or if there is a penalty for early repayment. These costs have to be declared before you sign.

State Regulations

Most states have regulations regarding all types of loans, and some states regulate title loans in terms of maximum amounts and interest fees. This information should be provided by the broker or lender, but you can easily check online. Also, most states require lenders to be licensed.

Will Car Title Loans Negatively Affect My Credit Score?

A title loan will not affect your credit score provided you repay the loan on time and your car does not get repossessed by the lender.

Am I Eligible for Auto Title Loans Online?

Most title loan lenders have few restrictions because the loan is already secured, but some require evidence of regular income to meet the repayments. You also need to prove you have sole ownership of the vehicle and that there are no other outstanding loans against it unless you are refinancing. Most title loan lenders will not be too concerned about credit scores.

Can I Get Title Loans Without Inspection?

Most online title loans do not require vehicle inspections, just details of the model, age, etc. Some lenders ask for recent photos of the car. A few lenders with physical stores may ask to see the car first, but most do not.

How Do Lenders Determine My Car’s Value?

Most title loan lenders use the same basic criteria to estimate a car’s value, such as the make, model, mileage, and overall condition. If you have upgraded the car or added extras such as a new music system this may be also considered.

Conclusion

Since car title loans are secured against collateral, they are easy to get, and in fact, some lenders can process the loan application and pay out the cash in a couple of hours. This makes car title loans a good choice for people who need money desperately and who have been turned away by other lenders.

But it is always important to check the terms and conditions before accepting a title loan to make sure you can afford to repay on time, so you don’t lose your car.