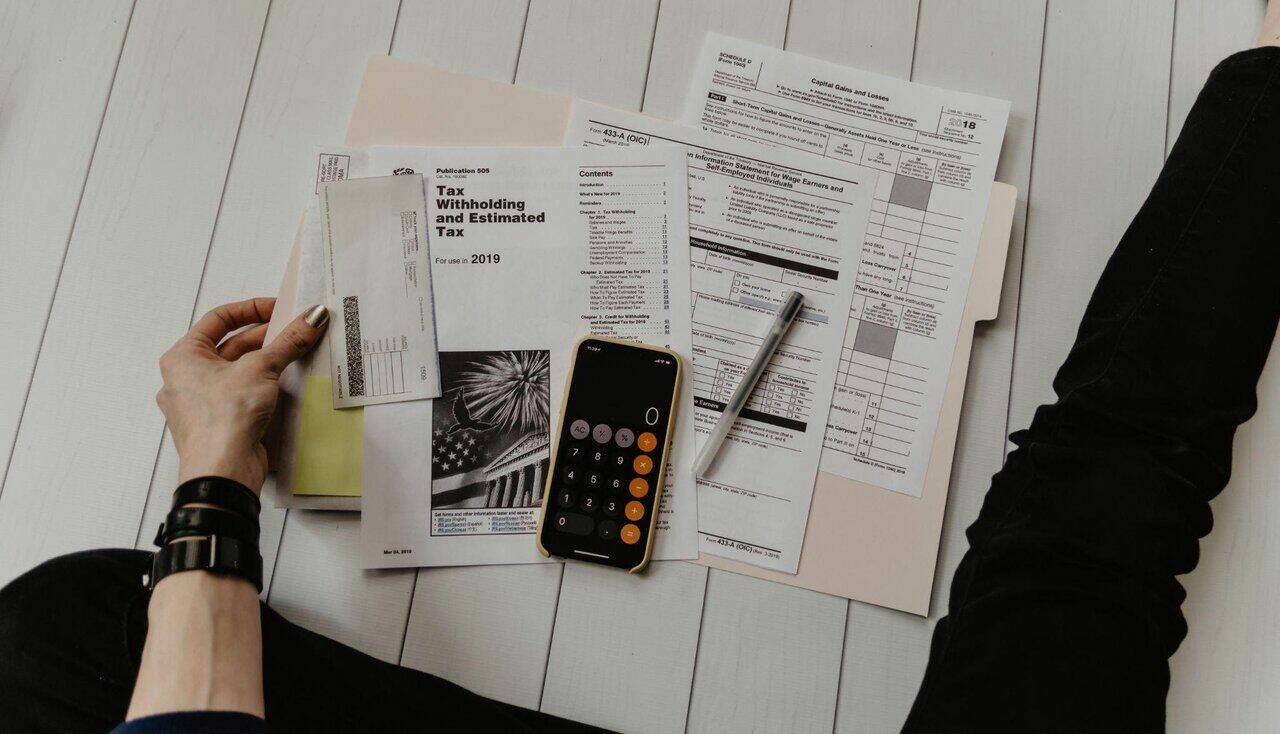

Online Payday loans are a great way of getting money in difficult times. Even if you have a regular job, we all know how unappreciated workers these days are. So needing a little extra cash is not embarrassing or a bad thing. We are all humans and we sometimes may spend our extra cash on things we don’t need, but when you need the money you know where to search for it.

Plus, there are plenty of platforms in this modern era that offer those services. I always say that there is a purpose in things that already exist. Take the chance and don’t ruin the moment of pleasure when you can get the money you need. After you go through this whole article, make sure to never forget us. We love to help people, especially those who need it the most. This is your sign, and if you thought there is no way out. There always is.

Top 5 Lending Platforms For Online Payday Loans

- MoneyMutual – Overall Best Payday Loans Online, Editor’s Choice

- BadCreditLoans – Exclusive Loan Lenders For Bad Credit Loans

- Radcred – Direct Lender for Quick Cash Approval & 24 Hour Loans

- CashUSA – Popular for Individuals with Bad Credit Score

- Personal Loans – Small Payday Loans with Guaranteed Approval

#1. MoneyMutual – Overall Best Payday Loans Online, Editor’s Choice

MoneyMutual is a popular platform that was created in 2010. MoneyMutual is the place you need to search for when you have an emergency and you need quick cash for your needs. Suppose you have some expenses about paying off your bills or renovating your house. No matter the cause, you can get the needed money. According to theislandnow, this brand works in a way that connects you with a potential lender.

You need to know that the money you’ll receive from MoneyMutual isn’t directly from them. To begin with the process of receiving the money, you need to give your personal information on the form that you can find on their website. The information is essential because based on that, you’ll get a match of other landers who would make you an offer. After that, it’s up to you whether you’d accept the offer or not.

Over the years, MoneyMutual has shown that it has an excellent reputation and is a reliable source for all the money emergencies people have. You can even negotiate with the lender and set the terms and conditions. Depending on how much money you need, you can borrow from $200 to $5,000. You don’t have to worry about when you will receive the money because it will happen in the next 24 hours.

Highlights

To begin the whole process of receiving the money, you need to give out your information when you go to the website of MoneyMutual. You should expect to be asked about your age, where you live, what your monthly income is, and whether that income is over $800. After you input all your details, you need to wait for a while until they are being processed.

When the potential lenders look through all of your details, they need to make an offer for you after they accept you. After you’ve been accepted, you’ll see a visible link on the site. All the things that are going on in the middle of you and the lender are secured, and no one can have access to them. When you read the terms, it’s up to you whether you’ll accept their offer or not.

When you’re using MoneyMutual, you’re not paying any additional fees to them. The whole process is up to you and the lender, and MoneyMutual is the bridge between the both of you. You don’t need to tell what cause you need the money and you can even use them to buy food for home. When you decide to take the loan, make sure that you’re not late with any of the loan payments because you’ll pay extra money.

Pros

- No additional fees for using the site

- Fast money

- Protected and secured connection

Cons

- Only citizens in the US can get this type of loan

Customer experience

MoneyMutual has over 2 million people who are obsessed and satisfied with this platform. The platform is transparent, and you’ll receive everything you want from them. Overall you’ll only hear positive things about MoneyMutual. If you search for Online Payday Loans, look no further than MoneyMutual.

=> click here to visit the official website of MoneyMutual

#2. BadCreditLoans – Exclusive Loan Lenders For Bad Credit Loans

Another famous marketplace for getting a loan is BadCreditLoans. This platform may be the oldest one out of the five brands 7/we’re mentioning today. It was founded 1999, and since then, they have built its reputation for making people’s lives so much easier. By using BadCreditLoans, you’ll be connected with other lenders to make an offer.

You’ll feel relieved once you hear that even though your credit score is terrible, you can still get a loan. After you apply for the money, it will be up to you to take the offer or refuse it. With this platform, you can request $500 at least to $10,000 at the most. What’s even more remarkable is that you’ll have 3 years to pay out the loan, which is enough time for you to gather the cost and return it.

The same way of application is applied here, and that is by giving your personal information to them. In the next 24 hours, you’ll receive the money. If you’re confused about this whole process, we’re going to explain everything to you. By allowing and giving out your information, there is a criterion that is used so you can match with your potential lender. Before you agree to any offer, make sure that you’re familiar with the terms. Once you sign the papers, you won’t be able to withdraw.

Highlights

When you’re meeting with this term for the first time, it’s always a good idea to have someone assist you throughout the whole process. This is possible with BadCreditLoan because their team is available 24/7 for any troubles that you’re having. As you previously read, you’ll have plenty of time to return the loan with this platform, especially if you decide to take three years for payment.

Like the other platforms, with this one, you’ll also be able to get your funds in about 24 hours after you’re approved. You can choose what type of lender you want, and that is a good thing. The catch is that you must be a US citizen and older than 18 years old. You’ll also need a regular monthly income to prove that you can return the loan.

The reason behind your decision to get a loan is your own personal matter. We suggest that you shouldn’t use the loan for luxury because with the monthly payments it will cost you a lot. You’ll be charged extra fees in cases where you’re late with the payments. You can easily skip late payments by setting a reminder in your calendar.

Pros

- A quick and straightforward process of application

- A reliable source for taking a loan

- Privacy is a priority to them

- You can withdraw your application

Cons

- For some people giving out personal information can be a bad thing

Customer experience

People with bad credit card scores found this platform to be handy. You can even search for the reviews about this platform, and you’ll be able to see only positive words about them. So no, having a bad credit card score doesn’t mean you’ll be denied a loan.

=> click here to visit the official website of BadCreditLoans

#3. RadCred – Direct Lender for Quick Cash Approval & 24 Hour Loans

RadCred is a relatively new company in the market but already gaining popularity because of its quality services. Their holy grail is finding the best lender based on your previous loan history. That gives you the freedom to communicate with your lender properly and have flexible terms. The only problem with RadCred is that you are limited in some choices here. For example, the company chooses whether a lender will pay you the money or not. If not, they’ll apologize and tell you to wait instead of finding a lender that offers a loan close to the amount you want. This means you won’t get a loan every time you visit RadCred.

There is no limit on the loan amount; you’ll get the exact amount if a lender offers it. RadCred follows other standards for loan processing and lender finding, but they disclose it to those who fill the form. You won’t get much information before filling out the form. However, the form is free to fill. They won’t charge you anything unless the lender starts the contract with you. Interest rates vary on the basis of the loan amount and the repayment time. Shorter loans mean higher APR and less repayment time, though you can always ask the lender to extend the repayment time.

You and the lender are responsible for the fees; you can contact the lender directly if you have any issues. RadCred is available until you find a lender; after that, everything stays between you and the lender, and the company will only cut the charges from the lender. The lender will deposit the funds within 24 hours in your account, but that time might differ on holidays. If you have a pending credit card payment, you can ask the lender to pay it for you.

Highlights

Here are the top features offered by this company:

- No chances of scam, fraud, and theft due to encrypted website

- The website is easy to navigate as they don’t have anything more than one an online form

- The lender verifies the information; they can be flexible even if they are hesitating to provide loans

- You can get the maximum loan of $5000, which might be not enough in some cases

- They transfer the money within 24-hours regardless of how much you want

- The lender can pay your expenses on your behalf instead of providing you with the cash

Pros

- Safe and easy personal loan service

- Local lenders part of the regional network

- A vast network of lenders

- Trusted cash advances

- All the information is secured and shared with your consent

Cons

- Limited loan amount

- New in the market, so not many people have tried it

Customer Experience

RadCred doesn’t have that many customer reviews since it is not an old portal in the market. However, the reviews it has, show how trustworthy this portal is. Customers were delighted that lenders provided money before the 24 hours window, and some customers stated they got the cash within hours after sharing their emergency details.

=> click here to visit the official website of RadCred

#4. CashUSA – Popular for Individuals with Bad Credit Score

CashUSA will give you a loan without you worrying about your bad scores on your credit card. CashUSA is the most reliable and trusted source for getting along. You’re also getting a guarantee that you’ll be approved of taking a loan. Like the previous ones, this platform works as a way to connect you with the lenders.

As we already said, your score won’t affect whether you’re getting a loan or not. The whole process of applying for a loan is fast and easy. You don’t need a lot of knowledge because the application consists of information that you already know. When you choose CashUSA, you can take a loan starting from $500 to $10,000. Expect the money to be in your bank account the next day.

With CashUSA, you’ll find solutions to your emergencies. You can use them and invest in a new home, pay off your medical bills, pay off your electrical bills, etc. This platform is reliable and will allow you to pay the loan between 3 and 72 months. You don’t need unnecessary panic because you have plenty of time to return the money.

Highlights

If you decide to choose CashUSA, you need to go to their official website to fulfill the application. The forms consist of you typing all your personal and financial details. To avoid any errors, you need to be careful when writing the details. After that, you’ll be assigned a lender who will make you an offer. When you decide to accept their offer, your money will be in your bank account the next day.

If you find it hard to finish the application, you can reach out to the team in CashUSA, and they’ll be more than happy to assist you. After putting all your details, you need to click on the Submit button. Then you should wait for the offers to come to you. Once you read all the terms and conditions and you agree with them, you simply accept the offer.

What you need to know about the payments is that even though sometimes you may forget to pay, the money from your bank account will automatically be transported to the lender’s account. This will help you from paying extra money for being late. It also saves your time going through the process of paying. So therefore, you’ll be on time even when you aren’t.

Pros

- CashUSA is completely free

- A lot of different lenders

- Easy navigation on the site

- Reputable brand

Cons

- You may need to put a little effort into going through the whole application process

Customer experience

If you search for CashUSA, you’ll see that there aren’t any negative complaints about the whole platform and the way it works. You’ll see it for yourself if you decide to choose this platform. Happiness and satisfaction are unavoidable with CashUSA.

=> click here to visit the official website of CashUSA

#5. Personal Loans – Small Payday Loans with Guaranteed Approval

Personal Loans is a marketplace that will give you a loan without looking at your credit card scores. This company was created in 2018, but it became very known to the public in a short time. All the information that you share will be protected and secured. When you decide to borrow money from Personal Loans, you can look through all the charges that each lender has.

That way, you’ll know how much you’ll pay for returning the loan. This way will help you to decide what loan you should accept without being unpleasantly surprised in the end. One little trick with Personal Loans is that your credit card scores will determine the amount of money you can receive.

The highest amount of money that you’ll get is $5,000. Once you’re approved, the process will be fast, and you may be able to get the money the very next day. The catch is that you must be over 18 or at least 18 years old to be able to apply for a loan. You also need to provide them with a type of a form that you’re getting monthly incomes.

Highlights

Filling out the form to apply for a loan will take you about 10 minutes. You need to give out your personal information and financial details. Once you finish with this step, you’ll get a list of offers by the lenders. However, you want you to have access to the Personal Loans site, whether it is through your tablet, phone, or laptop.

There won’t be any confusion because their site is designed to easily access everything and is easily navigated. You’re also not paying for the registration process because it’s completely free. The lowest amount of money that you can borrow is $200. When you go to their website, you’ll see the scale of points that apply to your credit card score. And based on that, you can see whether your score is excellent or poor.

If you have some troubles or issues, you can always contact the team of Personal Loans, and you’ll be assisted, where it will be cleared of all the confusion. In the information part, you may need to specify the account you want the money to be deposited in. Other than that, Personal Loans don’t make you go through the complex process of getting a loan.

Pros

- Transparent and free platform

- You can have access from your phone or laptop

- No hidden fees

- Encrypted site for safe exchanging information

Cons

- You may be accepted, but it doesn’t mean that you are approved

Customer experience

Personal Loans is an excellent way of receiving fast loans, and proof of that are thousands of loyal people who continuously use this platform. The transparency of this company is what catches everyone’s attention. And who wouldn’t want to receive money from a reliable source on the internet?

=> click here to visit the official website of Personal Loans

How Did We Make The List of Loan Places for Fast Payday Loans?

The process of creating this list of companies wasn’t easy but was totally worth it. You’ll be able to look through all those factors we considered to understand more why we chose those particular brands. Nothing can be done quickly, but with a little of our time and research, we are here today with all the information you’ll need before taking online payday loans.

Reputable brand

A reputable brand is easily noticeable, especially when you know what to look for. Usually, each of the good brands for payday loans has an excellent reputation and is known to everyone in public.

When you search the internet, you’ll see that the best companies are the ones who show up first. We made sure to avoid those dishonest companies who are thirsty for more money. Make sure to choose one of the best five brands.

Credit cards score history

Having a bad credit card score doesn’t necessarily mean that you’re an irresponsible person or unworthy of getting a payday loan. Sometimes things can happen, and you’re left with a bad score. We made sure that won’t be a problem for you in case you want to get a loan. In fact, the lenders of payday loans won’t even look through your history or your credit card scores.

Loan charges

Because charges are unavoidable and are part of the whole lending-receiving process, we ensured that the fees won’t be too high in cases where you want to take a loan. But you need to consider the fact that no matter how small the fees are in the beginning, if you’re late with your payment, they’ll increase.

Customer service

When you’re just now finding out about these types of loans, it’s good to have the company down your sleeve when you need something or when you have questions. Some companies disappear once you take their loan and won’t be available for anything else besides when you need to pay them back. That’s why we pick the companies with friendly services that will be with you every step.

More lender options

The more options a brand has, the easier it will be to find the most suitable choice for you. That way, by learning their terms and conditions, you’ll specify what you need and want in your application. The different lenders will offer you various deals so accept the one that looks the best for you.

Factors You Need to Consider Before Taking Instant Payday Loans

This essential part will help you get the knowledge you need to take some action when you need fast cash. Here is the list of factors that need to be considered from your side that will help you decide. So if you’re planning to take a loan, follow our criteria that are below.

The reputation of the company

This is the first thing you need to consider before taking a loan from a company you barely know. You need to search for all the information you can find about the company and how it operates.

You can even choose to see all the reviews from other people who have selected the company to be their lender. The more information you can find about a company, the better for you.

You can even input the company’s name on the search bar and see what the internet says about them. You need to know whether the company is reliable and trustworthy.

Conditions and terms

It’s an essential part to know all the conditions and terms that a particular lender has. This part usually comes after you finish the application for a payday loan.

So before you accept the loan offer, make sure to read all the information. This is important because you can’t go back once you sign the papers.

The loan contract should contain all the details about your payments, interest rate, and other information. You need to remember that in cases where you have bad credit scores, the interest rates will be higher.

Transparency and consistency

You may come across companies who have exciting marketing which, in the end, proves that they’re a fake company. That’s why it’s essential to look deeper than what seems to be an eye-catching design.

Some of the fake companies may charge you more fees than you previously planted. Also, when we’re talking about data transactions, and when there is your personal information involved, you need to be cautious.

Always pick a transparent brand that is honest and will provide you with all the information you need. Make sure to learn about the functionality of the company.

Privacy

When using these types of services, you are obligated to give out your personal information to finish the process. Therefore, it’s critical to choose a lender that can provide you with all types of privacy and security.

Some companies don’t take strict precautions to secure your information, which is awful. Find a company that has encrypted data protection.

The newest information that we gathered shows that some of the companies would sell your information to someone else. To avoid any of these things, you can choose one of the top five companies that we mentioned.

Time of the funding

When an inconvenience happens, you need to know what amount of money you need. It doesn’t matter what situation you’re dealing with, and you need a company that can provide you with the money as soon as possible.

Most companies will deliver the money the next day, while some will the same day. Choose wisely. You should consider that an additional fee may be included regarding fast loans. However, you’ll get the money you need at the end of the day.

FAQs Regarding Same Day Payday Loans

#1. What is the definition of a payday loan?

A payday loan is a term that is used when you need some cash for your purposes. This is only meant when you have an emergency type of situation and you need quick money. You also need to be responsible and based on the company that you choose, and you’ll have a different period to pay out that loan back. For example, if you’re working some type of job, your following income will help you pay out the loan.

#2. How much can you borrow from payday loans?

It depends on the company that you consider getting the loan. They usually give out from $100 to $1,000. Sometimes if you need a larger amount, feel free to request your own. And if they offer you a smaller amount, feel free to reconsider. It all depends on the lander and other essential factors.

#3. How soon should you expect the money to be in your bank account?

Usually, after 24 hours of you applying for the loan, you can receive the money. As we previously said, this depends on different factors. You can discuss all the terms with your lender.

#4. What do you need to acknowledge before you continue to apply for a payday loan?

You need to have a certain age which means you need to be at least 18 years old or older. You have to receive a monthly income with a certain amount of money. Some companies require you not to be a part of any Army, Air Force, Marine Corps, Navy, etc. If you want to know more about the terms and if you’re gullible, ask for more information.

#5. What information do you need to provide the company to get a payday loan?

Some personal information may be required, banking info, etc. You should expect to be asked about your name, email, security number, address, telephone number, the source of your income, driver’s license number, etc. Some of the lenders may even check your credit card score.

#6. How can you be sure that the information that you share is secured?

Many companies use SSL, which, in other words, is Secure Socket Layer encryption. That means that every bit of information that is shared between you and the lender is secured, and no one will get through.

#7. When do you need to pay off the lent money?

Because each of the independent lenders is different in their ways, they may require an additional time for you to repay the debt. You’ll get your answer by simply contacting the lender and asking for a date and time for your repayment.

#8. How long does an unpaid loan stay on your credit card?

If you have an unpaid loan on your credit card, it will stay on your credit card for seven years. Because of that, you may have a hard time getting approved for other loans. So here, you need to be really careful when you take this kind of loan and make sure you act responsibly towards it.

#9. Are online payday loans safe?

Yes, you can be sure that payday loans are safe the same way as taking out loans from banks. To avoid any bad things, choose a reputable company that will lend you the money.

#10. What will happen if you’re late with the payment?

Sometimes you’ll have to pay more than you received in cases where you’re late with the payments. Also, if you skip paying more than once, you’ll be charged with repossession of foreclosure.

But it all depends on the loan you’ve taken. And in case you close your checking account, the lender will take collection action as soon as you do that. There isn’t an easy way out unless you repay the loan responsibly.

#11. What to do if you decide you don’t want to use the payday loan you’ve taken?

It can happen to anyone. If you’ve taken a loan and don’t need it, you can simply return it. You may have to pay some additional fees and penalties when you choose this option. The second option is to take the money and spend it however you want. But you need to have in mind the monthly payments.

#12. After you get the loan, will you be asked what the purpose of your borrowing is?

No. No one will ask you what the causes are of your emergency need for some cash. There aren’t any restrictions, and you can use the money the way you want. People who use online payday loans usually need the money to pay some medical bills.

#13. Is your credit card score important when you need payday loans?

With online direct lenders, you don’t have to worry about your credit card score. They aren’t really interested in knowing the score, either. You only need to send out your application and wait for their approval.

#14. Will your credit card score change after you get a payday loan?

That depends on how responsible you are for repaying the loan you’ve taken. If you pay it back the way you need to, your score won’t be changed. In these cases where you’re repaying the loan on time, you can also improve the poor credit scores of your card.

Conclusion: Online Payday Loans for Bad Credit

We recognize the fact that sometimes unexpected things show up at our front door. It’s okay whether you have a school debt you need to repay or some expenses you need to invest in your house.

At this time, you have many options to borrow the money you need without feeling the pressure of everything going down the hill. What you need to do before you proceed with these payday loans online is to find a way to repay the money before you borrow them.

You should be responsible for your actions. Thousands of companies will lend you the money, and you just need to choose which one of them will be your lender.